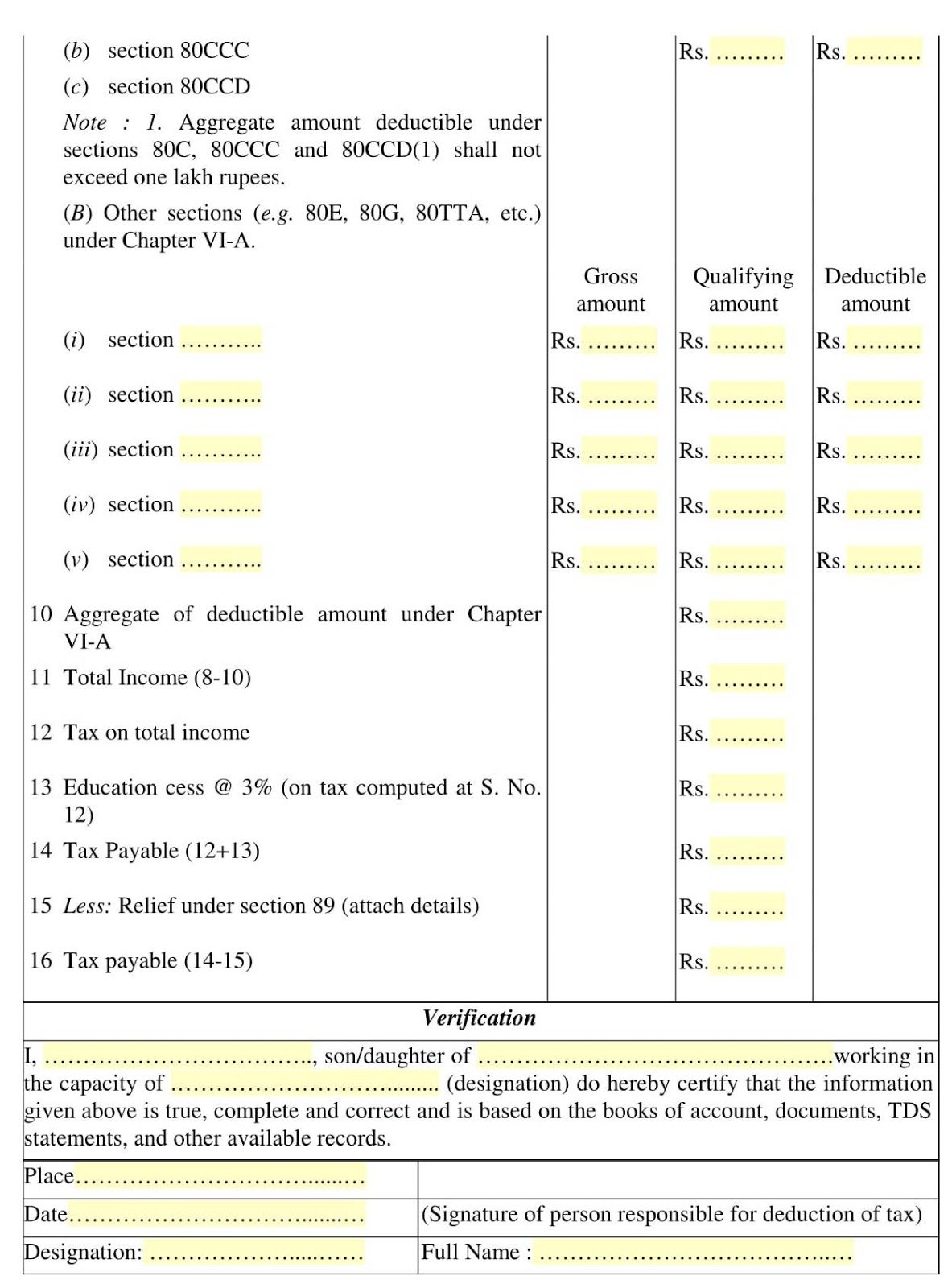

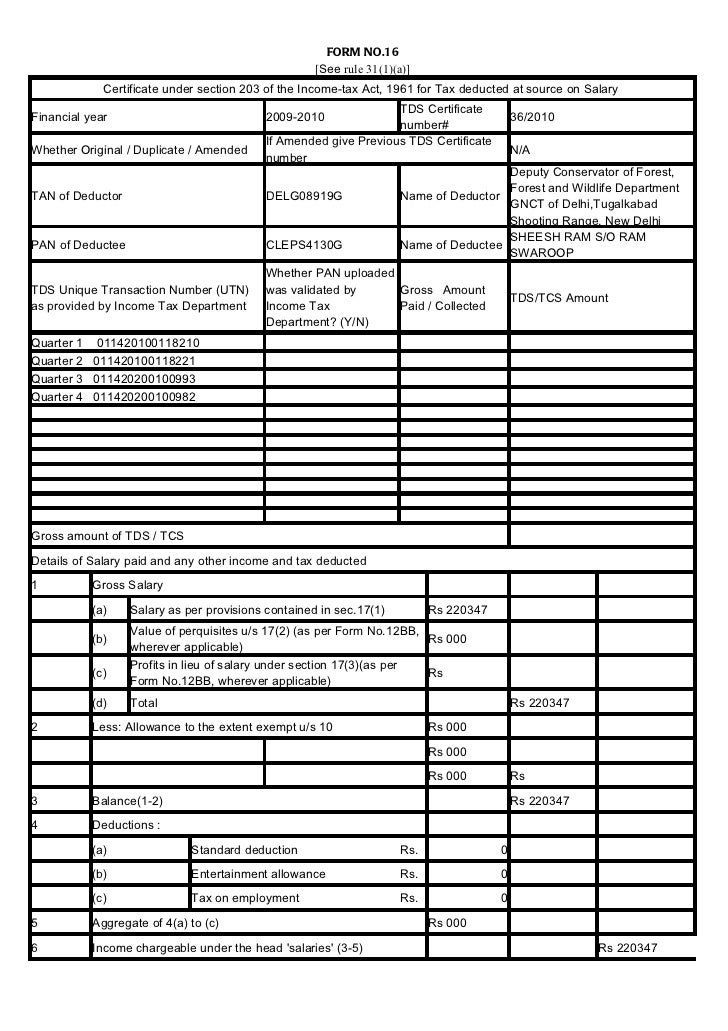

Deductor need to convert the downloaded Form 16 (Part-A & Part-B) zip files into PDF by using latest version of PDF convertor utilities available on TRACES.Downloaded file will be in ZIP format.Deductor can download Form 16 (Part-A & Part-B) by using HTTP Download accordingly once it is available.

Form 16 request can be placed once but two unique request number will be generated for Form 16 Part-A & Form 16 Part-B so that Deductor can download certificate accordingly.TDS certificates downloaded fro TRACES are non-editable.In case of invalid PAN or if the PAN is not reported in TDS statement, Form 16 will not be generated. Form 16 is generated only for valid PAN.Note: If Deductor wants Form 16Part-B through TRACES website and he filed 24Q annexure-ll before 12th May 2019 in that case Deductor need to file revision (in deductee details) in new format so that he can download the same through TRACES. As per “CBDT Notification 36/2019”,Deductors can download Form 16 (Part B) through TRACES from F.Y 2018-19 onwards.Form 16 (Part-A) can be downloaded from F.Y 2007-08 onwards for the statement processed by TRACES.Form 16 downloaded ONLY from TRACES are considered as valid TDS certificates, as per CBDT circular 04/2013 dated 17 th April‟2013.

0 kommentar(er)

0 kommentar(er)